colorado employer payroll tax calculator

W-2 W-3 and 1099 preparation. Purchase Options 941940 First-Time Purchase.

How Covid 19 Is Directly Impacting Your Payroll

You process all of the payments and we post your.

. Monthly quarterly and annual payroll tax reports. New hire file creation and reporting. Payrollguru app is a paid app for Windows Phone 7.

941940 Renewal plus Network Upgrade. WPRO-12 In addition to your current IRS tax withholding which is most likely based on your latest W-4 and based on your entries we suggest you withhold this additional tax amount in order to balance or reduce the taxes owed with your 2022 Tax Return. Its developed for business owners payroll specialist and payroll gurus that need to calculate exact payroll amounts including net pay take home amount and payroll taxes that include federal withholding medicare social security state income tax state unemployment and state disability withholding where applicable.

WPRO-11 Enter the date you will submit this W-4 Form to your employer or payroll department. Withheld payroll taxes are called trust fund taxes because the employer holds the employees money federal income taxes and the employee portion of Federal Insurance Contributions Act FICA taxes in trust until a federal tax deposit of that amount is made. The service option you choose defines how payments are processed.

An employer is required to withhold federal income and payroll taxes from its employees wages and pay them to the IRS. Comprehensive Payroll Processing ServiceWe manage the secure check processing and direct deposits. Free for personal use.

941940 plus Network Upgrade First-Time Purchase.

Payroll Tax What It Is How To Calculate It Bench Accounting

Income Tax Calculator 2021 2022 Estimate Return Refund

Understanding Your Tax Forms The W 2 Tax Forms Employer Identification Number W2 Forms

Free Online Payroll Calculator Online Payroll Calculator Employee Payroll Calculator

Sap Hcm Us Payroll Tax Calculation Illustration Sap Blogs

Common Payroll Tax Problems That Need To Tackle On Time Payroll Payroll Taxes Payroll Software

W2 Forms Google Search Tax Forms Employer Identification Number W2 Forms

Paycheck Calculator Take Home Pay Calculator

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

Free Online Payroll Calculator Online Payroll Calculator Employee Payroll Calculator

How To Calculate Colorado Wage Withholding Starting January 1 2022 Youtube

Individual Income Tax Colorado General Assembly

Pin On Relevant Tax Information Epf

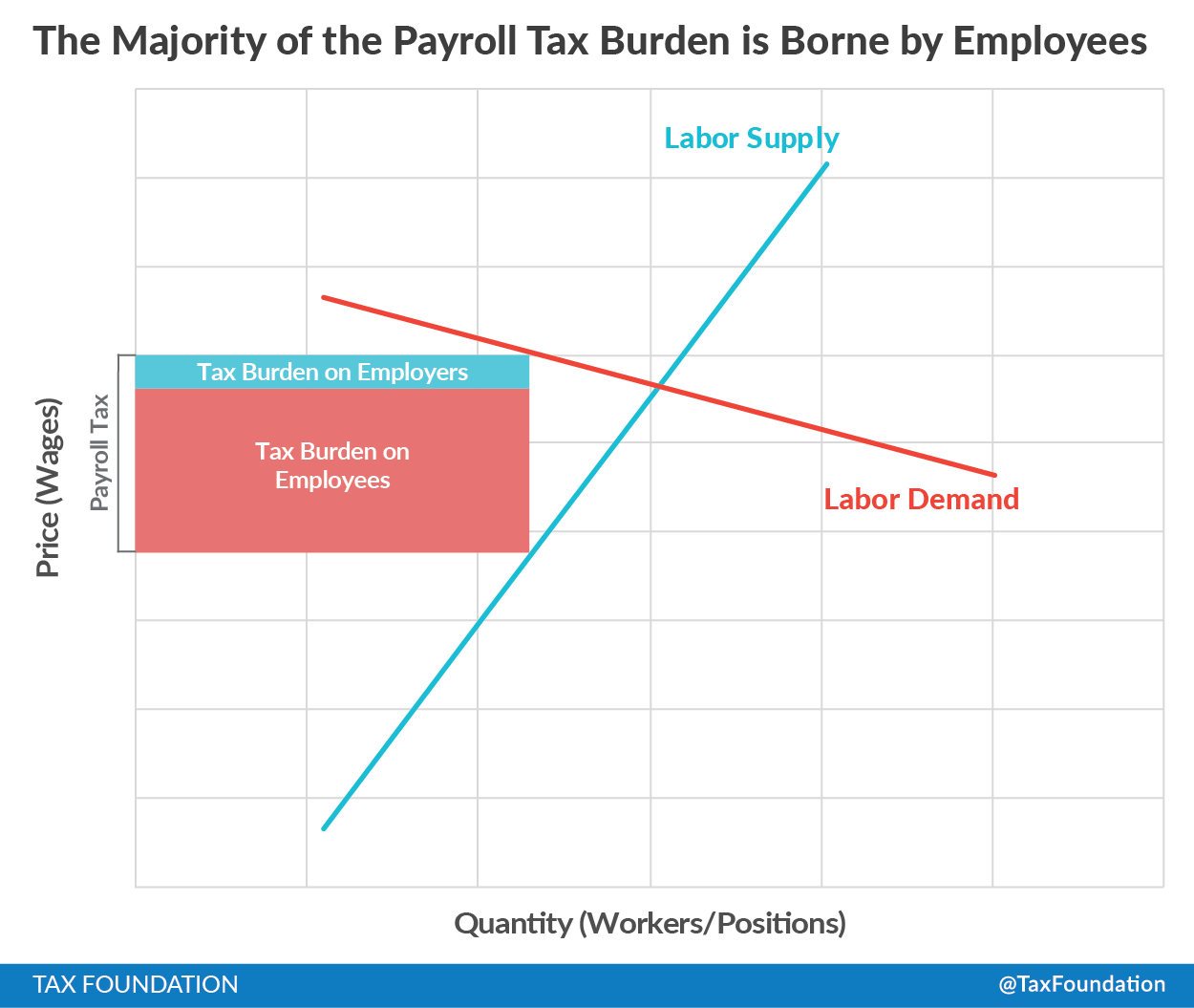

What Are Payroll Taxes And Who Pays Them Tax Foundation

Employer Payroll Tax Calculator Incfile Com

Self Employment Tax Calculator For 2020 Good Money Sense Business Tax Deductions Business Tax Money Management Printables

2022 Federal State Payroll Tax Rates For Employers

Tax And Payroll Services Business Tax Deductions Accounting Services Payroll